FINANCIAL SOUNDNESS FOR FAIS FSPS

”Category 1 FSPs may no longer subtract subordinated loans from the current liabilities”

What are the financial soundness requirements?

The FAIS Act explains the Financial Soundness requirements for FSPs in Chapter 6 of the Fit and Proper Board Notice 194 of 2017. The FSP must meet the financial soundness requirements at all times.

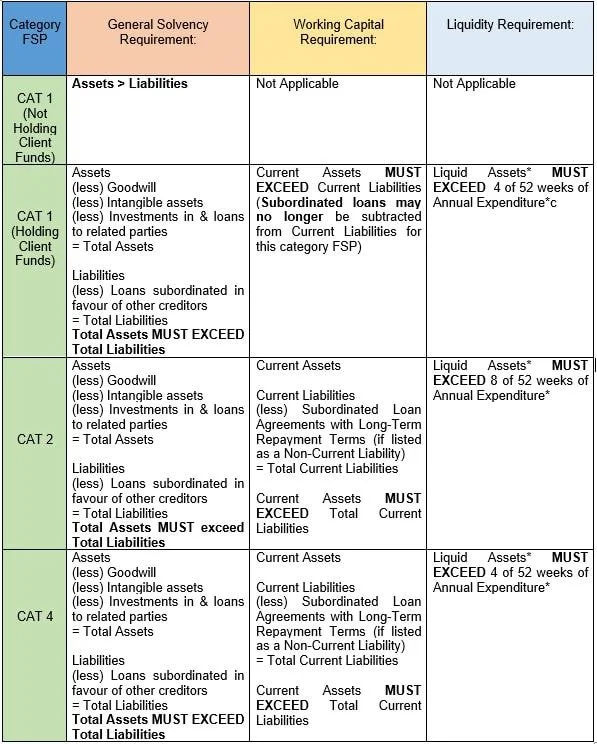

There are different requirements for different types of FSPs, however the three main categories for most of the FSPs are as follows:

General Solvency Requirement (Overall Outcome: Assets > Liabilities)

Working Capital Requirement (Overall Outcome: Current Assets > Current Liabilities)

Liquidity Requirement (Overall Outcome: Maintain Liquid Assets >= x/52 weeks of Annual Expenditure according to the FSP category)

What important changes took place regarding subordinated loans?

The most important change that we come face to face with almost monthly is the change where Category 1 FSPs may no longer subtract subordinated loans from the current liabilities in the working capital requirements. This requirement is applicable to Category 1 FSPs Holding Client Funds, and Category 1 FSPs Not Holding Client Funds.

How can an FSP ensure it meets the requirements?

The FAIS Act states that all FSPs should maintain monthly management accounts if these accounts are continuously monitored and compared with the financial soundness requirements the FSP should be able to maintain the financial soundness requirements.

What can an FSP do if they suspect that the requirements are not being met?

It is immensely important that the FSP follow one of these two steps as soon as the FSP suspects or foresees that the financial soundness requirements are not being, or will not be met, these are listed and explained as follows:

Early Warning Report

Rely on FSCA Exemption

The Early Warning Report is a report that can be submitted to the FSCA by the FSP or its Compliance Officers. The FSP must submit or request their Compliance Officer to submit an Early Warning Report that is certified by the CEO, controlling member, managing or general partner or trustee of the FSP, if one of the following financial statuses are true for the FSP:

Assets exceed liabilities by less than 10%

Current assets exceed current liabilities by less than 10%

If any of the financial soundness requirements are not met or if the FSP becomes aware of any situation that may result in any of the above

FSCA Exemption Application is an application that can be sent to the FSCA before the financial year end to assist the FSP with meeting the financial requirements as set out in the exemption application, this exemption does not mean that an FSP does not have to meet any of the requirements as set out in the Financial Soundness Requirements, but this exemption allows for some leeway between the Financial Soundness Requirements and the exemption requirements to assist the FSP to meet the requirements even if it is then by only meeting the requirements as set out by the exemption. There is additional documentation that must be sent together with this application within 7 days of relying on this exemption, these are as follows:

Annexure 6 (Form A: Liquidity Calculation) of BN194 of 2017 to the FSCA (Liquidity Calculation certified by the CEO, controlling member, managing or general partner, or trustee of the FSP.

An Action Plan showing how the FSP plans to re-establish its financial position to meet the financial soundness requirements and this plan should include the steps that the FSP will take and in what timeframe these steps will take place to ensure the financial soundness requirements that is not currently met, are met as soon as possible.

In addition to the above, the FSP must submit the following items every 6 months from the date that the FSP relied on the exemption:

Management accounts

Regularly updated Liquidity Calculation (Form A)

The exemption conditions are as follows:

How to calculate an FSPs Financial Soundness Requirements?

The Financial Soundness requirements can be explained and calculated as follows:

*Liquid Assets are calculated as follows:

Cash & cash equivalents +

(Plus) Participatory interest in a Money Market Portfolio

(Plus) 70% of the market value of a participatory interest in a CIS, other than an investment in a money market portfolio or a CIS hedge fund

(Plus) 70% of the market value of a security listed on a licensed exchange provided it does not constitute more than 50% of total liquid assets

= Liquid Assets

*Annual Expenditure is calculated as follows:

Annual Expenditure

(less) staff bonuses

(less) employees’ and directors’, partners’ or members’ share in profit

(less) emoluments of directors, members, partners or sole proprietor

(less) other appropriation of profits to directors, members and partners"

(less) remuneration that is linked to-

(aa) a percentage of the FSP’s revenue; or

(bb) a percentage of the revenue generated by an employee, representative or contractor of the FSP; and

that in the absence of such revenue the FSP has no obligation to pay the remuneration"

(less) depreciation

(less) bad debts

(less) any loss resulting from the sale of assets

Contact us for any information on the Compliance Officer services we provide for information on the financial soundness requirements, our team at Horizon Compliance are always keen to help.